The EUR/USD currency pair traded on Monday exactly as it did on Friday, Thursday, and so on. Regardless of which timeframe you look at, the picture is roughly the same. If there is any trending movement, it is extremely weak, "choppy," and is part of a larger flat. Recall that on the daily timeframe (i.e., in the medium term), the flat has persisted for six consecutive months. This is not a flat that formed after the main trend and several corrections. It is a flat that formed in the middle of a trend. In simple terms, the euro rose significantly in the first half of the year, and then the growth simply ceased. In the medium term, we have not seen any growth for the dollar. It has simply entered a flat. Overall, the American currency has pulled back 23.6% from its three-year lows, according to Fibonacci. This story has been ongoing (let us reiterate) for five whole months.

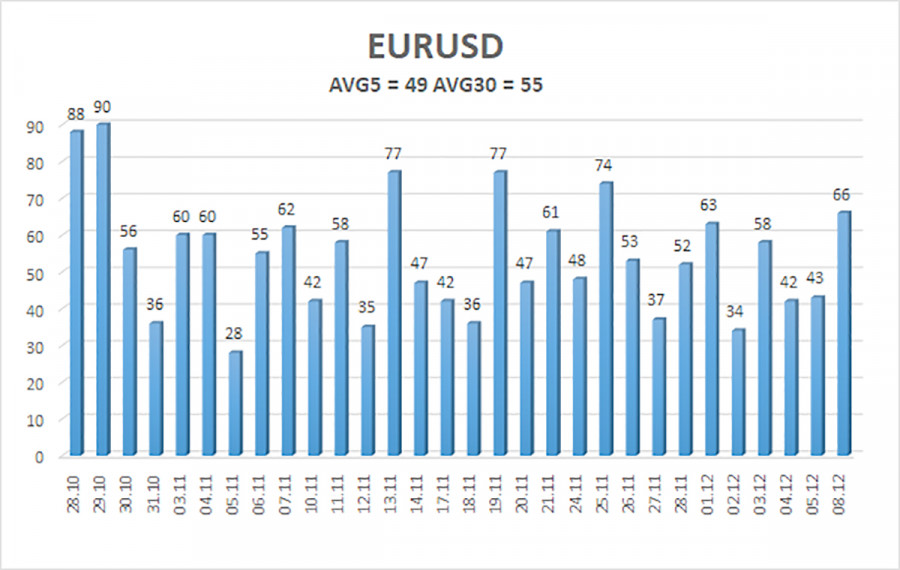

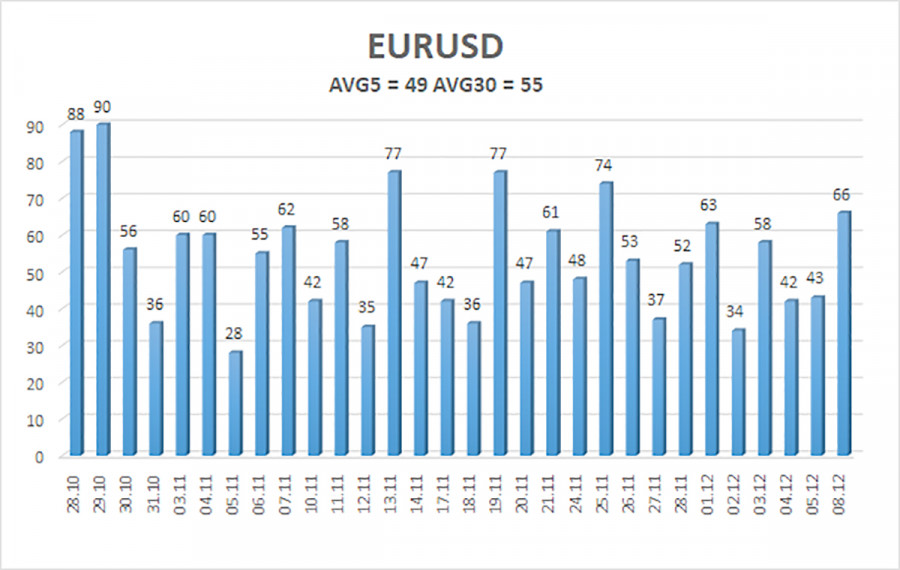

Naturally, on the lower timeframes, traders see movements, and on the very lowest, they even see trends. But what kinds of movements and trends can we discuss if the pair's average volatility over the last 30 trading days is just over 50 pips? Moreover, it should be understood that in practice, this figure does not mean 50 pips every day. It means two days of 60-80 pips and three days of around 30 pips. This suggests that three trading days a week have practically become non-trading days due to a lack of movement.

We smile at some expert assessments that say, "The dollar appreciated on Wednesday" or "On Tuesday, the European currency was under pressure." There are practically no movements in the market. What we see on the 4-hour timeframe is simply part of the flat. One might assume that since there are some short-term tendencies, trading on lower timeframes is possible. But once again: in most cases, the pair moves only 30-40 pips in a day. If a trading signal is generated, it often eats up about 20 pips of movement. As a result, traders can expect a maximum of about 20 pips of profit per day.

Thus, there is only one way out now — to trade long-term, on timeframes no lower than daily. And on the daily timeframe, we still see the same flat. The last drop within the range of 1.1400-1.1830 ended near the lower boundary, so now we can anticipate movement towards the upper boundary. Fundamental factors remain largely ignored by the market, and macroeconomic data are unable to trigger an end to the flat. Even the Federal Reserve meeting this week may have a minimal effect on the market. Volatility may spike temporarily, but then everything will return to normal. Thus, we can currently only expect very slow growth, and for more exciting movements, we need to wait for the end of the flat.

The average volatility of the EUR/USD currency pair over the last five trading days as of December 9 is 49 pips and is characterized as "medium-low." We expect the pair to trade between 1.1577 and 1.1675 on Tuesday. The higher channel of the linear regression points downward, signaling a bearish trend, but in fact, the flat continues on the daily timeframe. The CCI indicator entered the oversold area twice in October (!!!), which may provoke a new wave of the upward trend in 2025.

Nearest Support Levels:

S1 – 1.1627

S2 – 1.1597

S3 – 1.1566

Nearest Resistance Levels:

R1 – 1.1658

R2 – 1.1688

R3 – 1.1719

Trading Recommendations:

The EUR/USD pair is positioned above the moving average line, but on all higher timeframes, the upward trend is maintained, while the daily timeframe has been flat for several months. The global fundamental background still plays a significant role in the market. Recently, the dollar has often shown growth, but strictly within the sideways channel. It lacks a fundamental basis for long-term strengthening. When the price is below the moving average, small short positions can be considered with targets at 1.1597 and 1.1577 based solely on technical grounds. Above the moving average line, long positions remain relevant with a target of 1.1800 (the upper line of the flat on the daily timeframe).

Illustration Explanations:

- Price Levels (Support/Resistance): Thick red lines where movement may end. They are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Strong lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour timeframe.

- Extreme Levels: Thin red lines where the price has previously bounced. These are sources of trading signals.

- Yellow Lines: Trendlines, trend channels, and other technical patterns.

- Indicator 1 on COT Charts: Represents the net position of each trader category.